In Nepal, only certain types of businesses are officially called “companies”—these include Private Limited (Pvt. Ltd.) companies, Public Limited companies, and not-for-profit companies, all registered under the Companies Act 2063.

However, people often use “company” as a general term for any business, like a sole proprietorship or partnership. Legally, though, these types aren’t considered “companies” in the same way.

If you’re interested in different business types in Nepal—like sole proprietorships, partnerships, and companies—check out our guide, “Getting Started with Your Own Business in Nepal.“

For this article, we’ll be talking about Pvt. Ltd. companies specifically on how to Register a Company in Nepal.

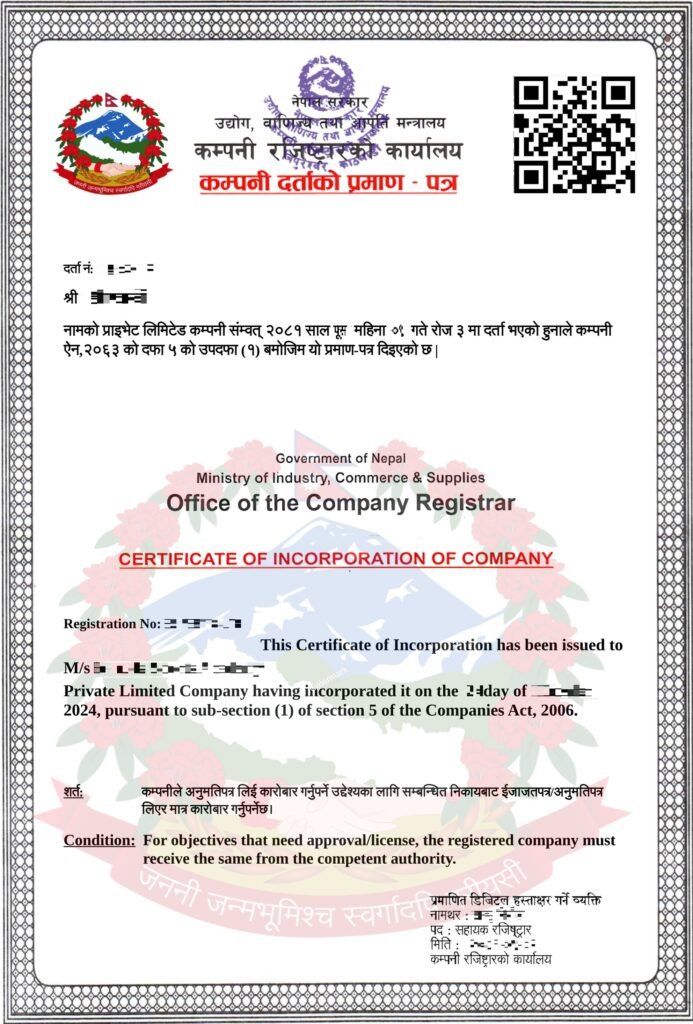

At the end of the registration process, you’ll receive certificate like this :

Benefits of Company Registration in Nepal

When you register a company in Nepal, it provides numerous benefits that can significantly enhance the credibility, operational efficiency, and long-term success of your business. Here are some key advantages:

1. Limited Liability Protection

One of the most significant benefits is limited liability protection. This means that the personal assets of shareholders are protected from business debts and liabilities. In case of financial trouble, shareholders are only liable up to the amount of their investment in the company.

2. Legal Recognition

A registered company is legally recognized, which adds credibility and trustworthiness to your business. This can be crucial when dealing with clients, suppliers, and investors, as they are more likely to engage with a registered entity.

3. Access to Capital

Registered companies, particularly private and public limited companies, have better access to capital. They can raise funds by issuing shares, securing loans, and attracting investors more easily than unregistered entities.

4. Perpetual Succession

A registered company enjoys continuous existence, meaning it can continue to operate regardless of changes in ownership or management. This ensures business stability and longevity.

5. Tax Advantages

Unlike sole proprietorship firms, companies are taxed at a flat rate, making financial planning more predictable.

6. Ease of Ownership Transfer

Owners can transfer ownership in a registered company through the sale of shares, making it easier to bring in new investors or exit the business without disrupting operations.

7. Enhanced Credibility

Registration enhances your company’s credibility and reputation, making it easier to secure contracts, attract skilled employees, and build trust with customers and partners.

8. Structured Management

A registered company operates under a well-defined legal framework with a clear organizational structure, helping to streamline decision-making processes and improve governance.

Registering your company in Nepal not only provides a solid legal foundation but also opens up numerous opportunities for growth, protection, and success.

Types of Companies in Nepal

In Nepal, companies are classified into several types based on their structure and purpose:

1. Private Limited Company

Single Shareholder Company: This type of private limited company is owned by a single individual who holds all the shares. It provides limited liability protection and is suitable for sole proprietors who wish to operate under a company structure.

Multiple Shareholder Company: This type involves two or more shareholders and is ideal for businesses with multiple owners or investors. It also offers limited liability protection and can accommodate up to 101 shareholders.

2. Public Limited Company

This type of company is designed for larger enterprises that seek to raise capital from the public market. It can have an unlimited number of shareholders and is typically involved in issuing shares through private placements or public offerings. Public limited companies are subject to rigorous regulatory requirements and extensive auditing.

3. Company Not Distributing Profits

According to the Companies Act, any company in Nepal can be established with the primary goal of developing and promoting specific professions, protecting collective rights and interests, or pursuing scientific, academic, social, benevolent, or public welfare objectives. This type of company is distinct in that it operates on the condition of not distributing dividends to its members. Instead of profit distribution, any surplus revenue is reinvested into the company’s mission and objectives. This structure is typically used for non-profit organizations, charitable entities, and public service organizations, providing a legal framework for achieving their social and community-focused goals while ensuring compliance with relevant regulations.

[Note : If you are searching for Different type of Business Structure in Nepal (say Sole Proprietorship, Partnership, Company), please refer to our another section ‘Getting Started for your own Business in Nepal’ ]

Register a Company in Nepal: Fees for Different Types

Here’s the fee structure to register a company in Nepal, presented in a table format:

1. Registration Fee for Private Limited Company

| Authorized Capital Range (NPR) | Government Fee for Private Limited Company (NPR) |

| Up to 100,000 (Up to 1 lakh / 0.1 million) | 1,000 |

| 100,001 to 500,000 (1 lakh to 5 lakh / 0.1 to 0.5 million) | 4,500 |

| 500,001 to 2,500,000 (5 lakh to 25 lakh / 0.5 to 2.5 million) | 9,500 |

| 2,500,001 to 10,000,000 (25 lakh to 1 crore / 2.5 to 10 million) | 16,000 |

| 10,000,001 to 20,000,000 (1 crore to 2 crore / 10 to 20 million) | 19,000 |

| 20,000,001 to 30,000,000 (2 crore to 3 crore / 20 to 30 million) | 22,000 |

| 30,000,001 to 40,000,000 (3 crore to 4 crore / 30 to 40 million) | 25,000 |

| 40,000,001 to 50,000,000 (4 crore to 5 crore / 40 to 50 million) | 28,000 |

| 50,000,001 to 60,000,000 (5 crore to 6 crore / 50 to 60 million) | 31,000 |

| 60,000,001 to 70,000,000 (6 crore to 7 crore / 60 to 70 million) | 34,000 |

| 70,000,001 to 80,000,000 (7 crore to 8 crore / 70 to 80 million) | 37,000 |

| 80,000,001 to 90,000,000 (8 crore to 9 crore / 80 to 90 million) | 40,000 |

| 90,000,001 to 100,000,000 (9 crore to 10 crore / 90 to 100 million) | 43,000 |

| Above 100,000,000 (Above 10 crore / Above 100 million) | Rs. 30 per additional 100,000 |

2. Registration Fee for Public Limited Company

| Authorized Capital Range (NPR) | Government Fee for Public Limited Company (NPR) |

| Up to 10,000,000 (Up to 1 crore / 10 million) | 15,000 |

| 10,000,001 to 100,000,000 (1 crore to 10 crore / 10 to 100 million) | 40,000 |

| 100,000,001 to 200,000,000 (10 crore to 20 crore / 100 to 200 million) | 70,000 |

| 200,000,001 to 300,000,000 (20 crore to 30 crore / 200 to 300 million) | 100,000 |

| 300,000,001 to 400,000,000 (30 crore to 40 crore / 300 to 400 million) | 130,000 |

| 400,000,001 to 500,000,000 (40 crore to 50 crore / 400 to 500 million) | 160,000 |

| Above 500,000,000 (Above 50 crore / Above 500 million) | 3,000 per additional 10,000,000 |

Documents Required to Register a Pvt. Ltd. Company in Nepal

To register a company in Nepal, several key documents are required. Here’s an overview of each document needed:

1. Memorandum of Association (MoA)

Purpose: The MoA outlines the company’s objectives, scope of activities, and the relationship between the company and its shareholders. It defines the company’s purpose, powers, and the extent of its liabilities.

Contents: It includes the company’s name, registered office address, the main business activities, and details of the shareholders, including their shareholdings.

2. Articles of Association (AoA)

Purpose: The AoA specifies the rules governing the internal management of the company. It outlines the procedures for decision-making, share transfers, and the roles and responsibilities of directors and shareholders.

Contents: It includes provisions related to the company’s management structure, dividend distribution, meetings, and appointment of directors.

3. Application

Purpose: This is the application used to apply for company registration signed by the promoters.

4. Power of Attorney

Purpose: This document authorizes an individual or entity to act on behalf of the company’s promoters in matters related to registration and legal formalities.

Contents: It includes the name of the appointed representative and specifies the scope of their authority.

5. Notarized Citizenship Certificates of Shareholders

Purpose: These certificates prove the identity and nationality of the shareholders.

Contents: Each shareholder must provide a notarized copy of their citizenship certificate to confirm their identity and legal capacity to hold shares in the company.

6. Witness Documents

Purpose: Witness documents are needed to validate the authenticity of signatures and declarations made in the company registration documents.

Contents: These documents typically include the identification details of the witnesses who attest to the signing of the MoA, AoA, and other relevant documents.

Preparing and submitting all these documents properly ensures a smooth and efficient company registration process in Nepal.Each document plays a vital role in establishing the legal foundation and operational framework of the company.

Company Registration Process Under New CAMIS System in Nepal

Effective from Shrawan 1, 2081 (16th July 2024), there is a new portal by the name of Company Administration Management Information System (CAMIS) to register a new Company in Nepal.

Step 1: Company Name Approval

- Create an OCR Portal Account:

- The proposed investor must create an account on the OCR portal.

- An email address (to serve as the username) and mobile number of the proposed investor are required.

- The system sends a one-time password (OTP) to the provided mobile number to validate account creation.

- Propose Company Name and Details:

- Once the account is created, the proposed investor submits the company name in both English and Nepali.

- Confirm the nature of the company (single or multiple shareholders, private or public).

- Select the objectives from a predefined list based on the intended activities of the company.

- Approval of Company Name:

- The OCR reviews and approves the proposed company name.

- Upon approval, the investor may proceed to the next steps.

Step 2: Registration of the Company

- Document Preparation and Upload:

- The investor must upload the required documents within 90 days from the date of name approval.

- Upload these documents to the OCR portal for review.

- Approval by OCR Officers:

- OCR officers review the application and submitted documents.

- If all requirements are met, they approve the application for company registration.

- Revenue Payment:

- Upon approval, the investor must pay the required registration fees.

- Issuance of Registration Number and Certificate:

- After payment, the system generates a registration number for the company.

- A digitally signed company incorporation certificate is issued, accessible through the OCR portal.

Further Registrations After The OCR Registration

Once your company is registered with the Office of the Company Registrar (OCR) in Nepal, there are additional registrations and procedures required to ensure full compliance and operational readiness. These steps generally include:

- Registration at Local Level (Ward Office)

- Obtain Permanent Account Number (PAN)

- Register with the Department of Small and Cottage Industries or Department of Commerce (if required)

Registration at Local Level (Ward Office)

Why to Register Business at Local Level (Ward Office) ?

Once a company is incorporated, it needs to register with the local ward office. This registration is required by the municipal authorities, which have the power to create their own regulations to manage local affairs. As part of these regulations, companies are expected to complete a business registration process with the municipality to ensure they comply with local rules and operate legally within that area.

When to Register Business at Local Level (Ward Office) ?

As a part of municipal requirement, the company must register itself with the ward office and accordingly pay a business tax prior to operation of business.

Where to Register Business at Local Level (Ward Office) ?

The company must register business with the concerned ward office where the registered address of the company is located.

How to Register Business at Local Level (Ward Office) ?

An application needs to be filed with the concerned tax office incorporating all the documents of the company. The company is also required to submit a copy of rent agreement based on which the company shall have to pay a rent tax at the time of business registration with the concerned municipal body.

Documents Required to Register Business at Local Level (Ward Office)

To register a business with the local ward office, certain documents are generally required, although specific requirements may differ by ward. The key documents typically needed include:

- Application Form – A formal application for registration.

- Company Incorporation Certificate – This includes the certificate itself as well as the Memorandum and Articles of Association.

- Company Resolution for Registration – A minute or resolution from the company authorizing registration with the ward office.

- Rent Agreement – A lease or rental agreement for the business premises.

- Citizenship Copies of Directors – Photocopies of citizenship certificates for all directors of the company.

- Land Ownership Documents – A copy of the land ownership certificate for the property where the business operates.

Obtaining Permanent Account Number (PAN)

When to Register or Obtain Permanent Account Number (PAN) ?

For any business to start its operation must obtain a Permanent Account Number (PAN) from the concerned tax office. With the incorporation of the company, the system itself reserves a PAN for the newly incorporated company. After the incorporation of the company, the board of directors of such company make necessary decisions to obtain PAN and nominate a person whose photo shall be attached in the PAN certificate. Based on the nature of business the companies are supposed to operate it may require to register itself under the Value Added Tax as well.

Why to Register or Obtain Permanent Account Number (PAN) ?

Following incorporation, it is mandatory for the company to register with the relevant tax office for tax purposes.

Where to Register or Obtain Permanent Account Number (PAN) ?

The company must file an application for tax registration with the appropriate tax authority, based on its registered address. Depending on the company’s location, this may be either the Inland Revenue Office or the Taxpayer Service Office within the designated jurisdiction.

How to Register or Obtain Permanent Account Number (PAN) ?

Submit Application: After incorporation, the company must file an application with the relevant tax office to register under the current income tax laws.

Online Submission: The application for PAN registration can be submitted online via the Inland Revenue Department portal at taxpayerportal.ird.gov.np.

Biometric Validation: The authorized representative, whose photo will be on the PAN certificate, must appear in person at the tax office for biometric verification.

Document Submission and PAN Issuance: Once all necessary details and documents are submitted, the tax office will issue a PAN certificate, signed by the responsible tax officer, officially registering the PAN Number of the company.

Documents Required for PAN Registration

The following documents are generally required to register for a PAN:

- Application Form – A completed application for PAN registration.

- Company Incorporation Certificate – This includes the incorporation certificate, Memorandum and Articles of Association, and any official letters issued by the Office of the Company Registrar.

- Company Resolution for PAN Registration – A company minute or board resolution authorizing PAN registration.

- Rent Agreement – A lease agreement for the company’s registered business address.

- Citizenship Certificates of Directors – Copies of the citizenship certificates of all directors.

- Location Map – A map indicating the physical location of the company.

Register with the Department of Small and Cottage Industries

Depending on its nature, a company may need to register as an industry with the appropriate government authority. This registration is typically required for companies involved in manufacturing or production activities. For example, if a company is set up for the manufacturing of clothing or production of food items like biscuits, it must register with either the Department of Cottage and Small Industry or the Department of Industry, as applicable, before beginning operations. This ensures compliance with industrial regulations specific to these sectors.

Why to Register ?

A company must register as an industry if its activities fall within the scope of “industry” as defined by the prevailing laws in Nepal. For example, a manufacturing company is required to register as an industry in accordance with national regulations. This classification ensures that the company complies with legal standards specific to industrial operations.

Where to Register ?

An application for industry registration must be submitted to the relevant Department or Office of Cottage and Small Industry based on the geographical location of the proposed industry. For instance, if the industry is to be located in Lalitpur District, the Office of Cottage and Small Industry in Lalitpur has the jurisdiction to register it.

What type of Business to Register?

Businesses involved in production, manufacturing, or service-oriented activities are required to register as an industry. This includes companies whose operations fall under these categories or similar classifications, as determined by relevant laws.

How to Register ?

- File an Application: Submit an application to the appropriate Department or Office of Cottage and Small Industry based on the location of the business.

- Submit Required Documents: Provide all necessary documents as specified by the department.

- Issuance of Registration Certificate: Once the application and documents are reviewed and approved, the department will issue an Industry Registration Certificate to the company, officially recognizing it as an industry.

Documents Required

The following documents are generally required to register a company as an industry:

- Application Form – A completed application for industry registration.

- Company Incorporation Certificate – Includes the incorporation certificate along with the Memorandum and Articles of Association.

- PAN/VAT Registration Certificate – Proof of tax registration.

- Company Resolution for Industry Registration – A minute or resolution authorizing industry registration.

- Project Scheme – A detailed project plan based on the company’s nature and activities.

- IEE/EIA Documents – Initial Environmental Examination (IEE) or Environmental Impact Assessment (EIA) documents, if required based on the company’s operations.

- Location Map and Property Documents – A map showing the industry location, copies of land ownership certificates, and recent electricity or water bills.

- Citizenship Certificates of Directors – Copies of the citizenship certificates of all company directors.

- Academic Certificates – Relevant academic qualifications of directors or employees, as required by the nature of the business.

Register with the Department of Commerce

To operate a trading business, a company with trading objectives must register as a commerce with the Department of Commerce, Supplies, and Consumer Protection. This registration is required to conduct trading activities, including import and export operations.

Why to Register ?

Registration as a commerce is essential for companies engaging in trading activities, especially for those involved in import and export, as it is necessary to obtain an EXIM (Export-Import) code from the Department of Commerce.

Where to Register ?

The registration process is handled by the Department of Commerce, Supplies, and Consumer Protection.

What type of Business to Register?

Companies involved in trading and commerce, including businesses focused on import and export, need to register with the Department of Commerce.

How to Register ?

- Submit an Application: The commerce registration application can be submitted online through the Department of Commerce’s portal.

- Document Submission: After submitting the online application, required documents must be provided in physical form to the Department.

- Issuance of Commerce Registration Certificate: Once all documents are reviewed and approved, the Department issues a Commerce Registration Certificate detailing the permitted business activities, such as local trading or import/export.

Documents Required

The following documents are generally required:

- Application Form – A completed application for commerce registration.

- Company Incorporation Certificate – Includes the incorporation certificate along with the Memorandum and Articles of Association.

- PAN/VAT Registration Certificate – Proof of tax registration.

- Company Resolution for Commerce Registration – A minute or resolution authorizing commerce registration.

- Citizenship Certificates of Directors – Copies of the citizenship certificates of all company directors.

- Shareholder Register – A record of shareholders in the company.

Obtain Exim Code

An EXIM Code (Export and Import Code) is a 13-digit identification number issued by the Department of Customs, Ministry of Finance (Government of Nepal). This code is required for businesses engaged in international trade for exporting and importing goods.

What type of Business is required to obtain exim code?

Businesses involved in trading activities related to export and import must obtain an EXIM Code to operate legally in international markets. Before applying for an EXIM Code, companies must first register with the Department of Commerce.

Process to Obtain an EXIM Code

To apply for an EXIM Code, the company must submit all required documents through the Nepal National Single Window portal (nnsw.gov.np). This portal facilitates the application process for international trade authorizations.

Documents Required for EXIM Code Application

- Application Form – A completed application for EXIM registration.

- Company Incorporation Certificate – Including the Memorandum and Articles of Association.

- PAN/VAT Registration Certificate – Proof of tax registration.

- Shareholder Register – Reflecting a minimum investment of NPR 1,000,000.

- Commerce Registration Certificate – Issued by the Department of Commerce.

- Citizenship Certificates of Directors – Copies of citizenship documents for all company directors.

- Tax Clearance Certificate – If applicable, proof of tax clearance.

- Bank Guarantee – An NPR 300,000 bank guarantee issued by a Class A bank.

- Bank Recommendation Letter – Provided by the company’s bank in the prescribed format required by the Department.

- Recent Passport-Sized Photo – A recent photograph of the company’s authorized representative.

Other Ancillary Tasks

Open Bank Account

For a company to open a bank account must first identify the bank and accordingly make a decision to open a bank account through the meeting of the board of directors of the company. The board on this shall also decide the name of the signatories to operate the said bank account. The documents required for opening a bank account are as follows:

a. An application

b. Company Incorporation Certificate including Memorandum and Articles of the Association

c. PAN/VAT registration certificate

Regulatory Requirements After The Registration of Company in Nepal

After registering a company in Nepal, you must follow several compliance obligations:

- Registered Office Notification:

- Notify the Companies Registrar Office of the company’s address within three months of registration.

- Filing Shareholding Details:

- After issuing and paying up share capital, prepare a Shareholders Register and file it with the Office of Companies within one month.

- Directors’ Details:

- Submit the details of the directors within seven days of them taking office.

- Annual General Meeting:

- Conduct an annual general meeting of shareholders within one year of establishment.

- Private companies are exempt if stated in the Articles and Memorandum of Association.

- Accounting Requirements:

- Keep accounts and have them audited by an auditor every year.

- The auditor is appointed by the shareholders and must be notified to the Office of Companies Registrar within 15 days of appointment.

- Filing Requirements:

- File annual audited accounts, auditor’s report, and the report about the number of shareholders within six months of the financial year-end.